Unlocking SCM Growth Potential: The Rise of By-Product Production within the Lithium Industry

The global transition towards renewable energy sources has set the stage for a remarkable surge in demand for lithium, a key component in rechargeable batteries. As electric vehicles, energy storage systems, and other green technologies gain momentum, the global lithium-ion battery market is currently valued at $52 billion and is expected to reach $194 billion in 2030. The world's largest lithium producers are gearing up to meet the increasing needs. However, what often goes unnoticed is the significant growth potential in the by-product production associated with lithium extraction and opportunities to development sustainable circular economy for these by-products.

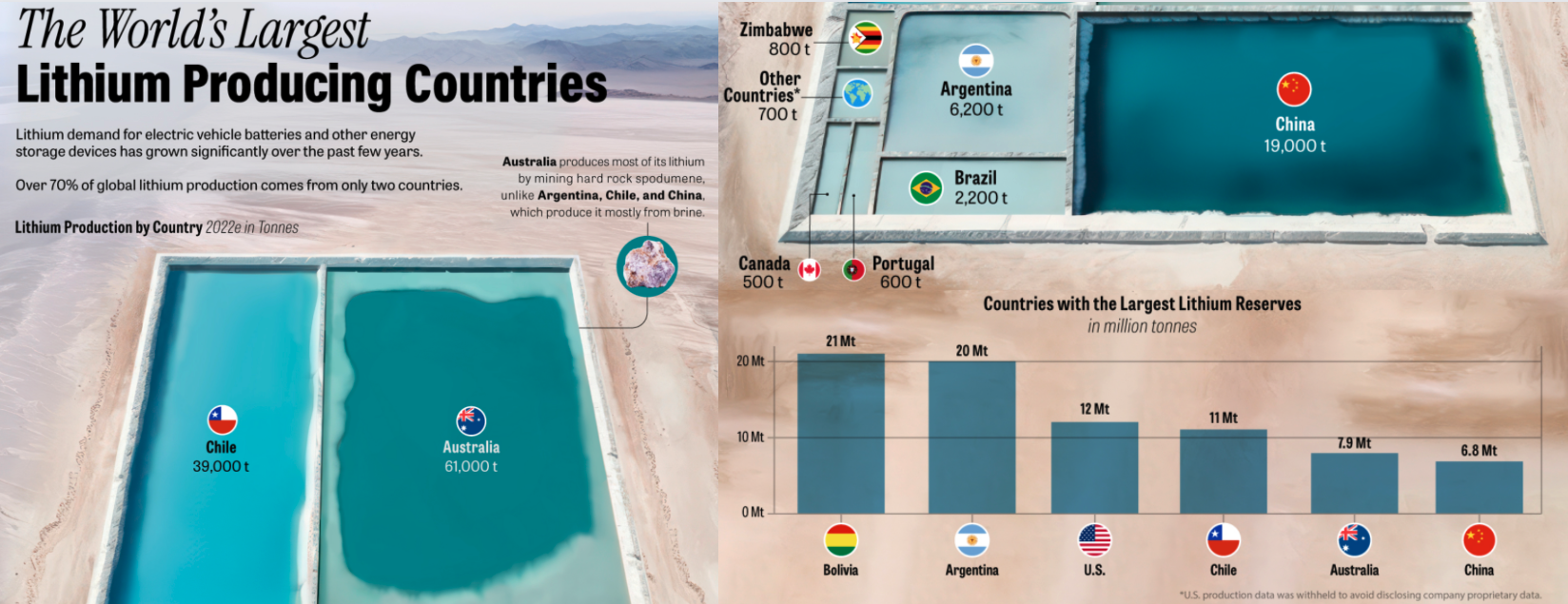

Countries such as Australia (61,000t), Chile (39,000t), and China (19,000t) dominate global lithium production, with several companies leading the way. However, these companies are not only focusing on lithium but have also placed a focal point on unlocking the potential of valuable by-products that accompany the extraction process to stride towards the goal of developing a ’circular economy.

Australia, the world’s leading producer, extracts lithium directly from hard rock mines, specifically the mineral spodumene as hard rock provides a greater flexibility as lithium hosted in spodumene can be processed into either lithium hydroxide or lithium carbonate. Additionally, it also offers faster processing and higher quality as spodumene typically contains higher lithium content. Whereas China along with other top producers extract lithium from brine as it offers the advantage of lowering production costs and a smaller impact on the environment.

Graphics/Design: Sam Parker

The Australasian Pozzolan Association, working closing with members in particular Tianqi and Covalent are developing a projected lithium by-product (DBS) for the next 30 years. Current estimates, based on new extraction projects planned, approximately 2 million tonnes of lithium by-product (DBS) will be generated annually by 2030 and over 4 million tonnes annually by 2052

To these ends, the Australasian Pozzolan Association commenced the develop a new Standard in 2019 through Committee BD-031, Supplementary Cementitious Materials. This new Standard, Supplementary Cementitious Materials Part 4: Pozzolans – Manufactured, would be complimentary to the existing series AS 3582:

- Part 1: Fly ash

- Part 2: Slag—Ground granulated blast-furnace

- Part 3: Amorphous silica

AS3582 Part 4 - Pozzolans – Manufactured was published in early 2022.

Objectives in creating this Standard were to encouraging resource efficiency, that is, to facilitate the beneficial use of manufactured pozzolans as mineral resources within a modern circular economy, using well-defined standards to provide market confidence in the resource use. Whilst natural pozzolans sources are well understood, there is an emerging class of manufactured pozzolans arising from various non-metallurgical and mineral processing industries which warrants greater attention given ‘Circular Economy’ drivers to maximise mineral resource use over the next 30 years.

Additionally, Dr. Warren South, a specialist in Cement and Supplementary materials in conjunction with the Australasian Pozzolan Association are currently continuing to work on publishing a scoping study providing insights into the historical usage, current resources, utilisation, market demand, pathway to market, research needs and strategies related to manufactured and natural pozzolans in Australia.

Overall, as the world is currently transitioning towards renewable energy sources, the stage has been set for a remarkable surge in demand for lithium. As electric vehicles, energy storage systems, and other green technologies gain momentum a particular focus must be placed on the significant growth potential within by-product production that is associated with lithium production over the next 30 years as we aim to create a “circular economy” to ensure that such raw materials and their by-products lose as little value as possible over many lifetimes of use.

Source :